salt lake county sales tax

2020 rates included for use while preparing your income tax deduction. Sales Tax Analyst.

The Dark Side Of Rising Home Prices Higher Taxes Opinion Deseret News

Puerto Rico has a 105 sales tax and Salt Lake County collects an.

. The County sales tax rate. This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for Salt Lake County Utah is.

What is the sales tax rate in Salt Lake County. See Publication 25 Sales and Use Tax General Information. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext.

Exact tax amount may vary for different items. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Salt Lake County Auditor.

The Utah sales tax rate is currently. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135. Get Your First Month Free.

The latest sales tax rate for South Salt Lake UT. This is the total of state county and city sales tax rates. SALES USE TAX ACT COMBINED SALES AND USE TAX RATES Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of July.

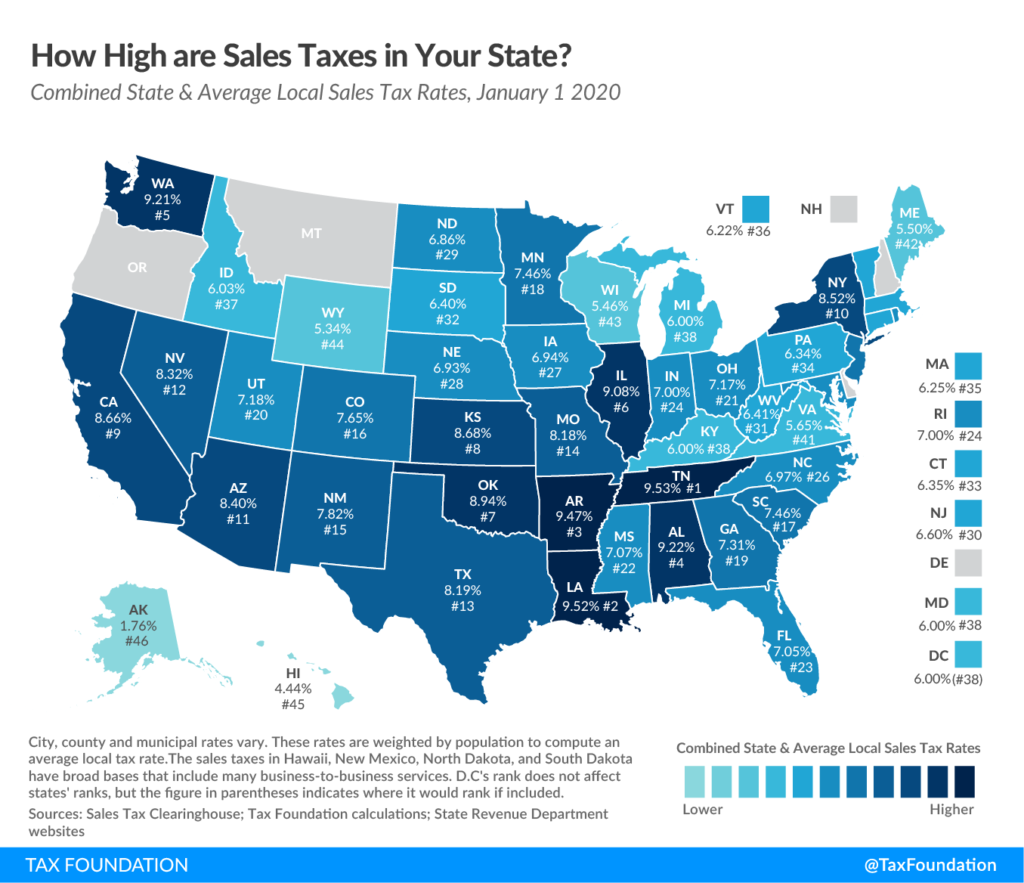

This page lists the various sales use tax rates effective throughout Utah. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. 2022 List of Utah Local Sales Tax Rates.

Sales and Use Tax Salt Lake City Utah has a 775 sales and use tax for retail sales of tangible personal property and select services which include but are not limited to admissions to. The Tax Sale is closed for 2022. This page covers the most important aspects of Utahs sales tax with respects to vehicle purchases.

4 rows Sales Tax Breakdown. 21 rows The Salt Lake County Sales Tax is 135. Notice of Value Tax Changes will be sent from the Auditors office by mid-July.

For vehicles that are being rented or leased see see taxation of leases and rentals. Tax rates are also available online at Utah Sales Use Tax Rates or you can. To find out the amount of all taxes and fees for your.

Salt Lake County is located in Utah and contains around 11 cities towns and other locations. 3 rows Salt Lake County UT Sales Tax Rate The current total local sales tax rate in Salt Lake. The total sales tax rate in any given location can be broken down into state county city and special district rates.

A Tax Sale is the public auction of any real property with taxes that have been delinquent for four years from the final tax payment deadline. 7705 or email to. Ad New State Sales Tax Registration.

If you would like information on property owned by. This is the total of state and county sales tax rates. Salt Lake County Assessors Office provides the public with the Fair Market Value of real and personal property through professionalism efficiency and courtesy.

2022 Utah state sales tax. Job in Salt Lake City - Salt Lake County - UT Utah - USA 84193. A county-wide sales tax rate of 135 is applicable.

Lowest sales tax 61 Highest sales tax. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other. Auditors office will start accepting property valuation appeals August 1 through September 15 2022.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. The minimum combined 2022 sales tax rate for Salt Lake City Utah is.

Please check back in 2023 for the next Tax Sale. County Sales Tax information registration support.

Salt Lake County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Salt Lake County Property Tax 2022 Ultimate Guide To Salt Lake City Property Tax What You Need To Know Rates Search Payments Dates

![]()

Tax Information Economic Development

What S Living In Salt Lake City Like 2022 Ultimate Moving To Slc Guide

23 Different Property Tax Hikes Proposed In Salt Lake County

Utah S Recent Sales Tax Reform Efforts And Sales Taxes Across The Nation Utah Taxpayers

Salt Lake County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Salt Lake City Utah Tourism Visit Salt Lake

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

Salt Lake County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Salt Lake County Property Tax 2022 Ultimate Guide To Salt Lake City Property Tax What You Need To Know Rates Search Payments Dates

Tax Increase Notices Coming To Salt Lake County Property Owners

Utah Sales Tax Small Business Guide Truic

What Historic Rise In Utah Home Values Means For Your Property Tax Bill Kutv

Salt Lake City Utah S Sales Tax Rate Is 7 75

Salt Lake City Utah Ut Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom